Just because you don't see form 1099-S, it doesn't mean it wasn't submitted to the government.

The Client

I have a client for whom we prepare individual tax returns each year. The client came to me via a referral from another client when they received a huge notice from the IRS.

What happened?

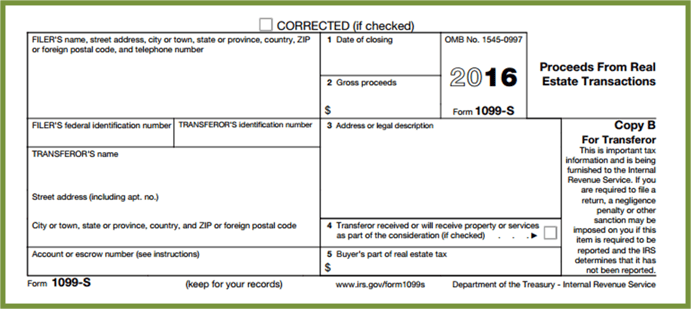

My client sold a home in the tax year in question. As a normal part of the transaction, a 1099-S was generated to reflect the proceeds of the sale. Unfortunately, as is also a fairly normal occurrence, my client did not see the 1099-S because it was buried in the stack of all the closing documents associated with the sale. This is one of those times when a tax document is not sent at year-end, so it is frequently missed. Complicating the issue is that 1099-S is not always generated for principal residence sales.

As a result, the IRS received the 1099-S but the client did not have it as part of his tax calculation on the return. The result was a notice indicating a tax liability of over $50,000.

The Solution

The solution is a simple one. We just amended the tax return, calculated the tax properly and the liability was completely wiped out.

What was at stake?

If the client had not been working with a CPA, the liability could have been paid in error. If they just ignored the notice and the amount was not paid, it may have resulted in the accumulation of interest and penalties. As a result, a lien could have been imposed on my client's new home or bank and investment accounts, causing chaos with my client's financial situation.

Conclusion

Be sure that if you moved during the year, you look through your closing documents for this form. You can also call the closing attorney's office to confirm whether this form was filed by them. When you sell your main home, often it results in zero tax liability because of the exclusion allowed to many taxpayers. However, you need to ensure that if a 1099-S is issued, you also report the cost basis of your home as well as the exclusion on your return so that the government is aware that there should not be any taxable income on the sale.

As always, we are here to help if you have questions!