You could be the savviest shopkeeper in town or the master of all things entrepreneurial. Regardless of whether you’re an absolute expert on your customers, your market, and your industry, there’s always the possibility of an unforeseeable accident. From natural disasters to security breaches to bio hazards, not all threats are immediately preventable. Your best bet? Business insurance. Ann Irons, a CPA in Bellingham, MA, shares five considerations for choosing business insurance.

Step 1: Evaluating Your Risks

Underwriting is the process by which an insurance company sets its acceptable threshold for risks, which they use to determine which policies are issued. An underwriter evaluates your insurance application, then makes a decision to cover all or some of the requested amount of coverage. As with any type of insurance, business insurance is comprised of a deductible and premium. Several factors influence the premium amount: the type of building used by your business, its physical location, and how much insurance you’ve purchased.

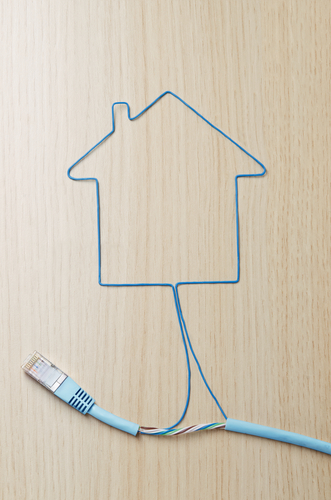

As cloud-based services become more popular among corporations and large law firms, smaller agencies and solo attorneys can’t help but take notice.

As cloud-based services become more popular among corporations and large law firms, smaller agencies and solo attorneys can’t help but take notice.